Satyam Computers chief B. Ramalinga Raju admits fraud

Ramalinga Raju may face 10 year jail

Ramalinga Raju may face 10 year jailSatyam Computers’ chief, B. Ramalinga Raju, ambushed investors and Corporate India on Wednesday, admitting to long-running fraud of about Rs 8,000 crores in accounting and said the company did not have the money that it had claimed it had.

He resigned later, saying his last-ditch efforts to fill the “fictitious assets with real ones” through the attempt to acquire Maytas failed. Mr Raju, who faces arrest, added that no other board member was aware of the financial irregularities.

His brother and managing director, Mr B. Rama Raju, stepped down as well, days ahead of its January 10 board meeting. Mr Raju will still be the chairman of Satyam Computers till the board is expanded.

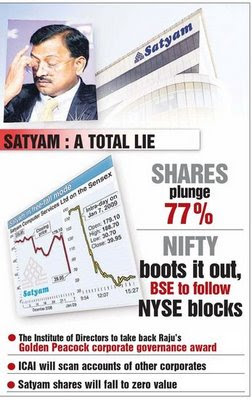

The news sent Satyam shares and the equity markets into a tailspin. The stock lost 90 per cent wip ing off more than Rs 10,000 crore market capitalisation. Trading in Maytas Infra was stopped because of the size of its fall.

The New York Stock Exchange halted trading in Satyam’s shares indefinitely in New York and Amsterdam, saying it wanted to review the news.

Satyam stock closed at Rs 39.90 on Indian bourses and $0.80 in the US market.

Satyam’s auditor PricewaterhouseCoopers, who overlooked the huge mismatch in numbers, says it was investigating the matter.

“If a company’s chairman himself says they built fictitious assets, who do you believe here,” said Mr R.K. Gupta, managing director at Taurus Asset Management.

Analysts said that was unlikely to satisfy investors. “I think there is no future for this stock,” said Mr Jigar Shah, senior vicepresident at Kim Eng Securities.

Mr Raju’s farewell letter explaining his fraud and his actions, revealed quite a lot. ? Mr Raju wrote: “The balance sheet carries as of September 30, 2008, Inflated (non-existent) cash and bank balances of Rs 5,040 crore (as against Rs. 5361 crore reflected in the books).” This was a confession that Satyam had cash and bank balance of only Rs 321 crore in October. ? When Mr Raju spoke of “accrued interest of Rs 376 crore which is non-existent,” he was speaking of report on Satyam by January 14. The government, he said, will refer the case to the Serious Fraud Investigation Office (SFIO) after the RoC verifies the facts. SFIO officials said it could take at least a year to investigate the fraud.

The minister said the government was coordinating with the Securities and Exchange Board of India.

In Mumbai, Sebi chairman C. Bhave said the investigation would have to go much beyond what the letter by Mr Raju contained.

As per the law, if convicted, Mr Raju will have to undergo jail up to 10 years and will have to pay 500 times the amount as penalty under Section 45 of the Sebi Act.

The Company Law Board and Registrar of Companies can initiate a suo motu inquiry on the basis of the statement given by Mr Raju on the inflation of funds.

“The RoC need not wait for a formal complaint as Mr Raju has admitted his guilt,” said Mr Veera Reddy, a senior advocate of the AP High Court. “A probe can be ordered under Section 235 of the Companies Act 1976.” Advocate Mr P. Subhash said Mr Raju’s statement involved criminal breach of trust.” “Producing forged or fictitious documents for personal gain amounts to criminal conspiracy.” Mr Subhash said police could launch an investigation based on Mr Raju's statement.

“The police should book a case under Section 477 (a) of the IPC dealing with the falsification of accounts.” The Institute of Charted Accountants of India could initiate a probe into the role of the auditors.

“If the Institute does not initiate the probe, an investor can file a complaint, contending that he invested the money based on the audit,” said Mr V.V.L. Narasimham, a chartered accountant.

Mr Veera Reddy pointed out that the company secretaries could also face an inquiry for their role in the fraud. “The directors can also come under the ambit of the probe under the Securities Contracts (Regulation) Act, 1956,” he added.

Source: DC

Comments